Introduction

Semiconductors constitute the backbone of the modern economy, powering a wide array of electronic devices — from smartphones and laptops to automobiles, spacecraft and warplanes. As such, they are not only drivers of productivity and innovation, but also carry profound military implications.

Over the last couple of decades, China’s semiconductor industry has undergone exponential growth. Its share of global semiconductor production capacity grew from roughly five percent in 1995 to more than 25 percent in 2020.1 Meanwhile, China is making inroads into the realm of advanced semiconductors. These chips can be applied to the next generation of advanced weapon systems, artificial intelligence (AI), and supercomputing. This quantum leap has raised red flags in Washington.2 Policymakers are wary of China’s ability to leverage advanced chips to accelerate its military modernization, which in turn may shift the power balance in the Indo-Pacific, thereby challenging the national security of the United States.3

Since President Donald Trump’s first term, Washington has adopted a more aggressive approach to thwart China’s efforts to acquire core US technologies in semiconductors. Several Chinese firms with suspected links to the People’s Liberation Army, such as ZTE, were added to the Entity List by the US Department of Commerce. However, this end-user export control reached its limit in the face of China’s “military-civil fusion” strategy, which allows Beijing to utilize civilian technologies to strengthen its military and appropriate resources between its military and private sectors.4 This strategy has triggered a fundamental reorientation in US export controls, moving the focus from traditional end-user checks to the technical characteristics of chips. An early success came in 2019, when Trump’s first administration pressured the Dutch government to prevent the Dutch semiconductor company Advanced Semiconductor Materials Lithography (ASML) from exporting its extreme ultraviolet (EUV) photolithography machines to China.5

The administration of former president Joe Biden further expanded the approach into a full-fledged export control regime. By setting performance thresholds, Washington prohibits the export of advanced semiconductors and related tools that could tilt military balance to China as a whole, rather than to specific entities. It also extended the reach of these controls through extraterritorial regulations and financial tools, aiming to ensure compliance by foreign suppliers and squeeze China’s footprint in the global semiconductor supply chain. Yet, given the mixed outcomes, the controls have fallen short of their stated goal. In effect, they have propelled the bifurcation between the tech ecosystems of China and the United States, substantially straining the sustainability of global supply chains.

As a country with minimal domestic manufacturing capacity, Canada relies heavily on imported chips to power its economy. This dependence has heightened its vulnerability to global supply chain disruptions, a weakness made evident during the COVID-19 pandemic. Moreover, due to a lack of domestic investment sources and a less developed commercialization environment, Canadian semiconductor firms are increasingly gravitating to the United States in search of funding and technological support, aggravating the sector’s loss of intellectual property (IP) and talent. This trend has also contributed to rising foreign ownership, making Canadian chip firms more likely to be caught by US export controls. This context highlights the urgency for Ottawa to strengthen its domestic semiconductor ecosystem and reduce exposure to geopolitically driven supply chain risks, particularly at a time when the Trump’s administration is seeking to repatriate US overseas semiconductor manufacturing capacity.

An Overview of US Semiconductor Export Controls

The manufacturing of semiconductors falls into three main segments: design; fabrication/foundry; and assembly, packaging and testing (APT). Each segment involves a variety of tools and materials due to the extreme precision required for the highly integrated, multi-step production process.

- Electronic design automation (EDA) software refers to specialized tools used to orchestrate the creation, simulation and validation of chips during the design stage.6

- Semiconductor manufacturing equipment (SME) refers to machines that facilitate “the precision, scale, speed, purity, and dependability required to sustainably produce semiconductors.” They are widely used in the fabrication and APT stages.7 Here are two examples:

- Lithography equipment is the fulcrum of fabrication, as it patterns the extremely small features of chips on the wafers. There are two kinds of lithography machines: EUV and deep ultraviolet (DUV). EUV used to be the only way to process high-end chips at 7nm nodes or below. Right now, this division is no longer the case, as multiple techniques have been invented to enhance the resolution of DUV.i

- Etching equipment is used to remove material from the surface of semiconductor wafers, revealing intricate patterns for integrated circuits.8

- In addition, “raw and manufactured materials, like silicon wafers, photomasks, and photoresists, along with certain chemicals, are necessary inputs across the semiconductor manufacturing process.”9

Washington and its allies hold a dominant position in the supply of these tools and materials. Three US-based firms — Cadence, Synopsys and Mentor (owned by Siemens) — occupy 70 percent of the EDA software market.10 In addition, companies from Japan, the Netherlands, the United States and, to a lesser extent, South Korea dominate the global SME market. For instance, only ASML, Canon, NuFlare, and Nikon can produce lithography equipment at scale, with ASML capturing 90 percent of the global lithography equipment supply and a monopoly in EUV machines.11 As for materials, three companies, two based in the United States and one based in Japan, supply between 70 and 80 percent of the global deposition, as well as the material removal and cleaning market.12 Four Japanese companies make up 72.5 percent of the global photoresist supply.13

In contrast, Chinese EDA software companies account for less than two percent of the global market.14 The localization rate of its SME and advanced DUV and EUV photoresist was under eight percent and two percent, respectively.15 Nonetheless, these disadvantages didn’t deter China’s ambition to establish a self-sufficient semiconductor ecosystem. Beijing has employed a multifaceted catch-up strategy to wean itself from reliance on Western suppliers. On the one hand, the Chinese government supports the domestic semiconductor industry in a whole-state manner through government subsidies, tax exemptions and other incentives. State-backed financing platforms have been established to fund semiconductor firms. Among them, the National Integrated Circuit Industry Investment Fund, also known as “the Big Fund,” has raised around US$95.7 billion in three rounds of financing.16

On the other hand, Beijing is actively leveraging international investment and technology through acquisitions of foreign firms, joint ventures, and tapping into the global talent pool. An illustrative example is that five California-based venture capitalists funnelled at least US$1.2 billion into China’s semiconductor sector between 2015 and 2021.17 Meanwhile, global talent staffed the management and research teams of the Chinese chip firms. Richard Chang, a US citizen who previously worked for Texas Instruments and Taiwan Semiconductor Manufacturing Company (TSMC), founded Semiconductor Manufacturing International Corporation (SMIC), China’s largest foundry and key logic chip producer, and invited more than 400 professionals from Japan, South Korea, Taiwan and the United States to build his team.18

Prior to the advent of reoriented US export controls in 2022, China’s semiconductor industry saw continuous progress. From 2011 to 2020, the number of registered chip companies grew 17-fold, from 1,300 to 22,800.19 A series of impressive achievements emerged during this period. For example, SMIC achieved the 7nm process technology with a DUV machine.20

US semiconductor export controls are largely built on Washington’s (and its allies’) dominance over hardware, IP, talent and capital along the global semiconductor supply chain. At the core of these controls is a set of continually updated performance thresholds. They are designed to forestall the export of high-end chips, EDA software, and SME with potential military applications to China.21 Notable targets include Nvidia’s A100 and H100, the most sought-after chips in the AI industry, and ASML’s advanced DUV lithography machines, which Chinese firms rely on for high-end chip production.

Washington also prohibited “US persons” from supporting the development or production of high-end chips at certain semiconductor fabrication facilities located in China.22 The result was that US toolmakers such as Applied Materials, KLA-Tencor and Lam Research were compelled to withdraw their staff from facilities in China. It should be noted that “US persons” is a broad term with expansive reach. Not only US individuals and entities, but also any “juridical person organized under the laws of the United States or any jurisdiction within the United States,” including branches of Canadian firms, could be considered “US persons.”ii

As mentioned above, the semiconductor supply chain is highly complicated and globally distributed. To ensure compliance by foreign suppliers, Washington has invoked several federal regulations to extend the global jurisdiction of the controls.

First, under the de minimis rule, if a non-US-made item contains a threshold percentage of US-origin content (normally 25 percent or more), it will automatically fall under the jurisdiction of the controls. Regarding chips destined for China, “there is no de minimis level for foreign-made items that incorporate” controlled US-origin content, also known as the “0% de minimis” rule, which means the threshold can be lowered to any point above zero.23

Second, under the Foreign Direct Product (FDP) rule, foreign items will be subject to the US export controls “if certain highly controlled U.S.-origin content is used to produce them and if that content is controlled in the receiving foreign country.” The covered items include direct products of US-origin technology or software, made by a plant or major component that is itself a direct product of such technology or software, or containing components produced by such a plant or component.24 For example, the Dutch government’s suspension of ASML’s EUV exports to China was driven by concerns over compliance with the FDP rule, as Cymer, ASML’s US-based subsidiary, conducts light source engineering and supplies 85 percent of EUV components.25

Besides, there is a financial dimension of the US export control regime aimed at pre-empting the leakage of core IP to China through investment, and cutting off American capital from funding China’s semiconductor firms.

Any inbound investment in technologies, infrastructure and data businesses with national security implications will be scrutinized by the Committee on Foreign Investment in the United States (CFIUS), an affiliate of the Treasury Department.26 Here, “US business” is broadly defined to cover any transaction involving US-based activities, even if the parties are foreign entities. For example, the acquisition of Magnachip Semiconductor, a South Korea-based chip company, by Wise Road Capital, a Chinese private equity firm, was blocked by CFIUS for national security concerns on the grounds that Magnachip was incorporated in Delaware and publicly traded on the New York Stock Exchange in 2021.27

Regarding outbound investment, the Outbound Investment Security Program (OISP), led by the Secretary of the Treasury, has been established to prohibit “US persons” from engaging in certain transactions involving quantum computing, AI systems and advanced semiconductors with countries of concern (currently only China, including Hong Kong and Macau).28 Notably, non-US persons involved in these transactions, referred to as “covered foreign persons,”29 might also fall under OISP’s jurisdiction if they are from a country of concern and engage in sensitive activities, or have significant ties to such a country, or participate in a joint venture with a US person in covered activities.30

These rapidly evolving controls signal Washington’s determination to cripple China’s semiconductor ambitions by impairing its domestic innovation ecosystem.31 While it remains uncertain whether the evolving controls will ultimately lead to a de facto decoupling, the emergence of “two separate but linked manufacturing ecosystems — one domestic to China and the other part of the global mainstream” is already underway.32

The Brittleness of Canada’s Semiconductor Autonomy

This transformation is set to put countries such as Canada in a precarious situation, as its pillar sectors, such as automobile, mining, finance, AI and education, all rely on imported chips to upgrade their technology and research. During the COVID-19 pandemic, the unexpected chip shortage wreaked havoc on Canada’s economy, with its manufacturing industry being hard hit. Between August 2020 and July 2021, auto production shrank 6.6 percent, reaching the lowest point since the 1982 recession.33 Geopolitical tensions have further exposed the vulnerabilities in Canada’s chip supply chain, as 60 percent of Canada’s chip imports originate from Asia and Oceania, a region characterized by persistent territorial disputes among several major chip suppliers.34

However, Canada’s public and private sectors are not well positioned to help its chip industry navigate supply chain disruptions. Unlike China’s Big Fund, there is no public fund dedicated to building a robust domestic chip manufacturing capacity. Most public funds for tech companies are catch-all in nature, forcing semiconductor firms to scramble for limited resources with competitors from other areas (see Appendix A). Compounding the issue, these funds are modest in size, effectively capping the amount of investment available. More troublingly, a significant share of the capital is being channelled into multinational corporations. For instance, two among the four chip-related projects funded by the Strategic Innovation Fund are administered by local branches of American companies.35 Private venture capital is an even less viable alternative. Very few private investors can afford the staggering initial and follow-on investments — often exceeding CDN$100 million — required to develop a semiconductor company.36

Additionally, Canada lags behind in building a robust commercialization ecosystem for semiconductor firms. While a number of non-profit organizations and incubators have been established to help scale startups through research support, fundraising and product development, none are specialized in semiconductors except for the Hardware Catalyst Initiative (see Appendix B). Moreover, some have been blamed for lacking the necessary expertise and tools to effectively support their participants’ growth.37

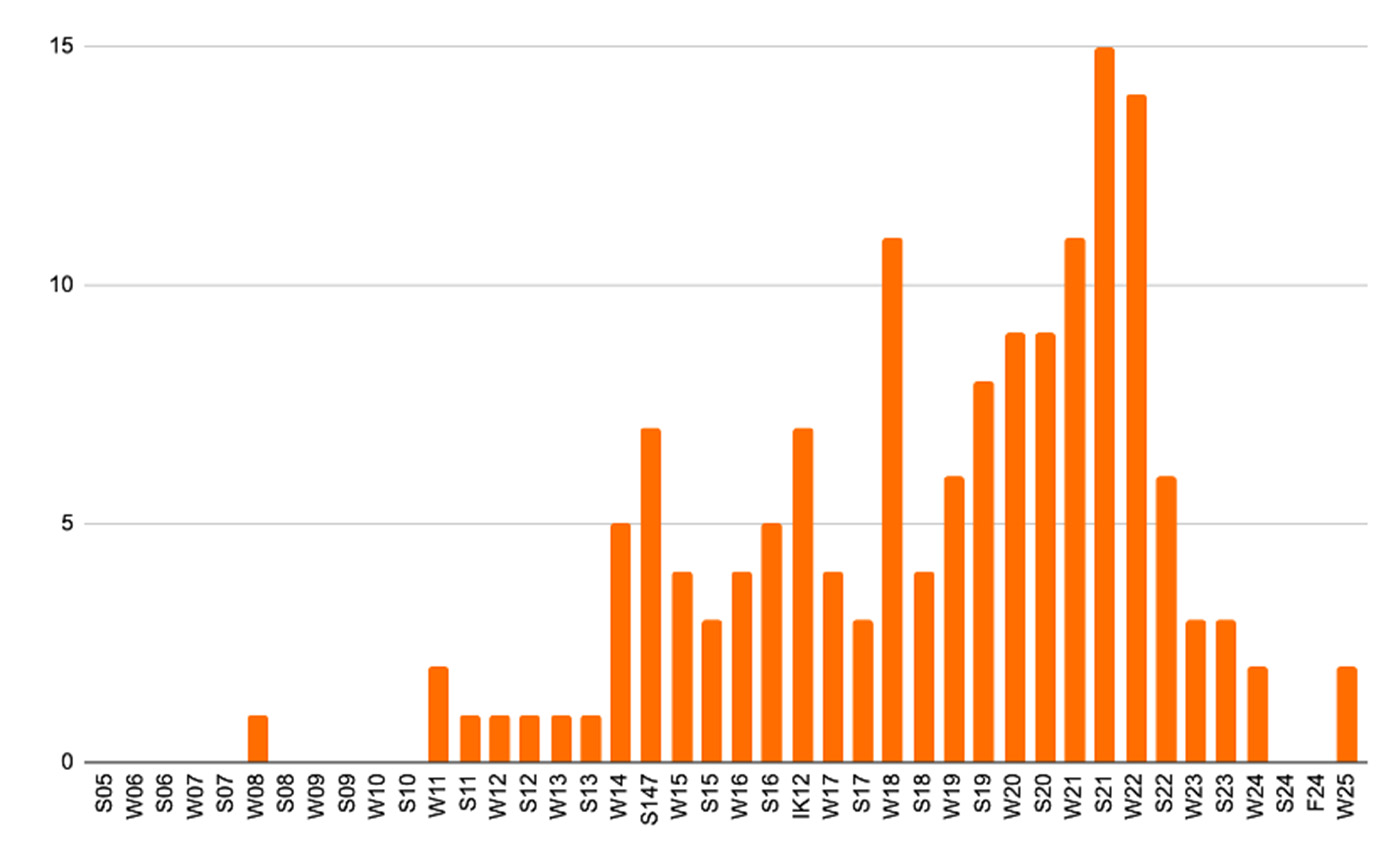

Against this backdrop, a growing number of Canadian firms are flocking to the United States in search of investment, expertise, customers and connections — often at the expense of giving up part or all of their equity.38 High levels of foreign ownership have become common among Canadian tech firms. Several flagships of Canada’s chip sector, such as ATI Technologies, once a major rival to Nvidia in graphics processing units, and DALSA Corporation, the country’s leading foundry, have been acquired by American companies.39 Some Canadian companies have simply relocated to the United States to gain easier access to investment and technology.40 As noted by Garry Tan, CEO of the Silicon Valley–based incubator Y Combinator, Canadian founders who remain in San Francisco after Demo Day are 2.5 times more likely to build unicorns than those who return.41

Canadian-headquartered Companies in Y Combinator by Cohortiii

The rise of foreign ownership is always associated with the loss of IP and a persistent brain drain, eroding Canada’s potential growth in productivity. Between 1998 and 2017, the percentage of Canadian-invented patents sold to foreign entities rose significantly, from 18 percent to 45 percent.42 Meanwhile, local STEM graduates continue to leave due to limited opportunities and lower salaries in Canada. Between 2015 and 2016 alone, 30.44 percent of computer engineering, 15.56 percent of physics, and 14.04 percent of electrical engineering graduates relocated to the United States.43

Driven by these dynamics, Canada’s semiconductor sector is increasingly absorbed into the US chip production ecosystem. What remains in Canada is a tenuous domestic manufacturing capacity and a light footprint in the global semiconductor supply chain. In 2022, Canada exported semiconductors valued at CDN$1.4 billion to the United States.44 By comparison, the number for Malaysia — a country with a GDP just over half the size of Canada’s — was CDN$17.96 billion.45 With deep reliance on American capital, technology and talent, Canadian chip firms are very likely to be classified as “US persons” or “covered foreign persons” under US export controls.

Since the COVID-19 pandemic, a new consensus has emerged among Canadian business leaders and policymakers: the global supply chain is unreliable, and it is imperative for Ottawa to take bolder moves in building a robust onshore semiconductor manufacturing capability. As Tony Pialis, the co-founder and CEO of Alphawave, noted, Canada ranks low on other countries’ “priority list,” and things will be no different if another semiconductor shortage occurs. He emphasized, “If there’s ever going to be an opportunity for change, now is the time. And if we don’t push for it, Canada will always be in Big Brother’s shadow.”46

The escalating tensions between Beijing and Washington are the latest alert underscoring the brittleness of the global supply chain, which should encourage Ottawa to approach its semiconductor sector from a national security stance. As François-Philippe Champagne, then Minister of Innovation, Science and Industry, remarked in 2022, “Semiconductors are at the centre of Canadians’ daily lives and Canada’s economy. By investing in semiconductors today, we are investing in economic security and sustainability for all Canadians.”47

From Dependence to Resilience: Repositioning Canada Amid US–China Semiconductor Rivalry

US export controls have largely been a response to the escalating geopolitical rivalry between Washington and Beijing. They are designed to impede China’s indigenization efforts in the semiconductor sector and impair its domestic ecosystem. However, the surprising release of Mate 60 Pro and DeepSeek has demonstrated the striking resilience of China’s chip sector under extreme pressure.

Mate 60 Pro, a smartphone launched by Huawei, features Kirin 9000s, a system-on-chip manufactured by SMIC’s 7-nm process.48 Its performance and power consumption profile was on par with one- to two-year-old Qualcomm chips, while its radio frequency rivalled Qualcomm’s then best. Kirin 9000s demonstrates China’s potential to produce advanced chips at 5nm or below nodes.49

DeepSeek — a Chinese AI company that develops large language models — is another bombshell that rattled Silicon Valley and Washington. Its V3 model has delivered performance comparable to top US models such as OpenAI’s GPT-4, released seven to eight months earlier at a fraction (five percent) of the cost. It has massively reduced the need for human testers and improved post-training accuracy.50 By leveraging an assembler — a programming language that interacts directly with hardware — DeepSeek developers have maximized the performance of older-generation chips and thereby eased the reliance on advanced Western chips.51

Meanwhile, US export controls have galvanized Beijing’s push for self-reliance, forcing Chinese firms to collaborate and innovate for domestic alternatives. Companies across chip design, fabrication and APT are clustering around Huawei, the cornerstone of China’s semiconductor sector. The firm has established partnerships with SMIC for fabrication, SMEE for semiconductor manufacturing equipment, and JCET and Tongfu for packaging.

This does not mean, however, that US export controls have left China’s chip sector unscathed. Alternative methods with dated tools always come at a higher production cost, lower yield rate and longer time, hurting the profitability of Chinese firms. In 2024, the net profit attributable to shareholders of SMIC and Huahong declined by 23.3 percent and 80.34 percent, respectively.52 In effect, Mate 60 series and DeepSeek emphasize the stickiness of China’s tech sector to Western hardware. It is speculated that the Kirin 9000s was processed by China’s existing inventory of DUV equipment,53 while DeepSeek’s V3 model was trained on a fleet of AI chips comprising Nvidia’s H100, H800 and H20 — totaling around 50,000 units.54

More importantly, the controls themselves reflect a growing consensus within the Beltway that free trade is no longer able to defend national interests, and the United States needs to reshore its overseas semiconductor capacity. Therefore, there is good reason to expect that the momentum of the controls will be maintained in Trump’s second term. Secretary of Commerce Howard Lutnick pledged that he would stay “strong” in curbing China’s chip sector. On April 9, 2025, the Trump administration added Nvidia’s H20, AMD’s MI308 and their equivalents to the control list — a restriction that was initially discussed by the Biden administration but did not come about before Biden’s term ended.55

This move doesn’t mean the Trump administration will stay on the track set by its predecessor. For example, the Department of Commerce has rescinded the AI Diffusion Rule initiated by the Biden administration in January 2025.56 Instead, the Trump administration is weighing the possibility of replacing it with mutual governmental agreements as part of a broader scheme to overhaul the global trade system.57 Another notable move is the investigation into national security risks of imported semiconductors and SMEs under Section 232 of the Trade Expansion Act. It serves as a precursor to imposing a tariff, reflecting the administration’s intent to accelerate the reshoring of overseas semiconductor manufacturing capacity, an approach that could put Canada’s chip sector at stake.58 A telling example is Trump’s threat to impose a 25 percent tariff on iPhones manufactured overseas if Apple refuses to reshore its production.59

The following suggestions aim to tackle the upcoming interruptions caused by US export controls and to promote a robust domestic semiconductor manufacturing capability:

- Enhance research on the potential evolution of US semiconductor export controls and their resulting impacts on Canada’s chip industry and the global supply chain, and formulate corresponding policy recommendations.

- Build strategic chip reserves without delay to buffer against potential shortages amid disruptions in the global supply chain, in particular those triggered by a military conflict in Asia and Oceania.

- Work with like-minded partners to strengthen chip resilience and decrease dependence on unreliable nations by diversifying the supply chain away from geographic hotspots.

- Implement stricter policies to review foreign investments through a national security lens, restrict foreign ownership in critical chip-related firms, and protect Canadian-origin IP.

- Establish targeted public funds with ample capital to strengthen Canada’s onshore semiconductor manufacturing by subsidizing flagship firms in R&D, infrastructure modernization, and production expansion.

- Promote the formation of incubators and non-profit organizations equipped with practical expertise and capable of delivering enhanced services to foster a thriving commercialization ecosystem for hardware and semiconductor-related firms.

- Engage anchor companies in Canada’s pillar industries — such as automotive, energy, home appliances and telecommunications, including Bombardier, Danby, Linamar, Miovision, and Telesat — to build a strong domestic market for semiconductors, and further embed the semiconductor industry into the Canadian economy.

- Strengthen the pipeline of technical jobs to retain Canadian talent and attract top global professionals by reforming immigration streams and offering more competitive salaries and benefits.

- Promote the proven model of tax incentives, such as Scientific Research and Experimental Development, to offer tax credits, reductions or holidays for semiconductor-related firms.

- Create a simplified and transparent permitting process and eliminate redundancies across federal, provincial and local regulations.

Conclusion

The latest move of the Trump administration acts as a renewed wake-up call for Ottawa to confront the brittleness of Canada’s semiconductor autonomy. In an increasingly divided global supply chain, Canada must take concrete steps to foster a resilient and competitive domestic chip manufacturing base via sufficient domestic investment and a vibrant commercialization ecosystem. Otherwise, the country risks seeing its semiconductor sector relegated to a technological backwater, with hard-won IP and talent continuing to flow outward.

Acknowledgement

The author expresses gratitude to Dr. Derek Hall, Hamid Arabzadeh, Ph.D. candidate Alex Panovski, and Kyle P. Haromy for their valuable insights and contributions to this paper.